529 Contribution Plans

The American Dream: own your house, and if you have kids, to get them a college education. In the second part of the American Dream there’s a social pressure that a parent must send your kids to college. I understand why a parent feels this social pressure of sending their kids to college. I have a kid of my own and worry holding up my end of the American Dream as well. This article, along with a series of others, will discuss a common way to turn that Expensive American Dream into a reality, by using 529 contribution plans.

The purpose of this article is not to say 529 contributions plans don’t make sense, it’s more to help a parent understand that just because someone says tax advantage or benefit does not mean it’s the best course of action. As with all investment and tax, every situation is different and should be reviewed in totality of your economic profile. This article is to give some background to try and make your decisions easier.

Background:

529 contributions plans refers to the IRS code that allows these plans to have tax advantages.

There are 2 types of 529 contribution plans:

- College prepayment plans – which allow you to buy a tuition voucher at the current rate and use it going forward without inflationary costs of the rise in the price of college.

- Savings plans – which allows you to contribute money into an investment vehicle and then withdraw that money at a future time to use it for qualified college expenses. This article will really focus on the savings plans. Thus from here on out, when I’m stating 529 contribution plans, you should assume it is talking about the saving plans, though many items below also pertain to the college prepayment plans.

The benefits of 529 contributions plans are:

- Any gains on contributions into the 529 contribution plans, such as dividends & capital gains, are not taxable when withdrawn to pay for qualified college expenses;

- Many states allow for contributions (with various limits) to be subtracted from taxable income in the year which the contribution was made;

- The 529 investment plans are run by state agencies which have investment managers (Fidelity for example) that usually allow multiple investment positions, including bonds & mutual funds, that you can vary your investment based upon your risk profile, thus a good (but not great) variety of investment options;

- Forces an individual to save money for your child’s college education and not use for other expenses; and

- You are allowed to assign a beneficiary of the account, but can change that beneficiary at any time. There is also a pretty large list of who can qualify as a beneficiary and change be changed multiple times during the plan.

The # 1 benefit above is a future benefit, in that you will only realize the benefit when you withdraw in a future period.

The # 2 benefit is a current benefit, in an individual having a slightly lower income tax expense for state tax only. The benefit is only available in states that have state income tax (9 states currently don’t have state income tax)[1] and offer the deduction (nine currently don’t allow a deduction for 529 contributions)[2]. This benefit, while nice, is not as large a benefit that we are lead to believe. Let’s say you are in Illinois that allows up to a $10,000 contribution[3] for an individual to be deducted from your state income used for your state income tax calculation. If you contribute $10,000 in 2018, at the 2018 4.95% Illinois state income tax rate, you are only saving $495. {Sidebar – When reviewing state income taxes as well, it’s key to understand the timing of contributions and deductions. Many states have no time limit on how long the contribution must stay in the 529 plan (and the few that only have a short time period of a year that the contribution must stay in the contribution plan before withdrawal). Thus one could contribute the maximum contribution allowed under the state deduction limits and then a year later withdrawal that money to pay for college tuition.}

The # 3 benefit, while on the face looks nice, has serious consequences of lost opportunity costs. This is my biggest concern when someone is just dumping money into a 529 contribution plan. In order to experience the benefits of # 1 & # 2, you must weigh the opportunity costs of not putting your money elsewhere but into a 529 contribution plans.

The # 4 benefit, is really an inability to prioritize or control your spending. While this is more of a control, the below might make you rethink if this is the best control mechanism.

For right now, let’s ignore the # 2 benefit, state income tax benefit. One thing I’ve mentioned a few times is “qualified educational expenses”. So let’s say you start up a 529 contribution plan and your child decides not to go to college & decides they don’t want kids either (thus avoid issue with benefit # 5). Say you might have contributed $54,000 over 18 years, with that investment, thanks to gains, is now at $123,000 after 18 years. Then you withdraw the cash, but since no child to pay for qualified educational expense, you now have a 10% penalty on all your contributions[4], plus have to pay tax on all gains. Say your gains tax rate is 15%, you now have a $17,250 tax bill ($69,000 gains x 10% penalty + $69,000 gains x 15% capital gains tax). This penalty will be assessed similarly in many different situation where you just needed to withdraw cash.

Thus the opportunity costs comes in 2 places:

- Your cash is “trapped” in an investment vehicle that cannot be used for anything besides educational expenses. Do you have short term cash available for a car repair, new roof, losing a home, down payment for a house? You should answer yes for all of these before you think about contributing money to a trapped account.

- You are only able to earn investment gains (which is really your only tax advantage), using the investment fund chosen by the state.

The way 529 savings plans are set up, the state basically has to set up a 529 plan, much like your employer sets up a 401k plan, say with Fidelity. From there you are only able to invest in their funds. These funds, as always have fees that go directly to Fidelity, which is why so many investment companies are fighting and eager to set up a 529 contribution plan or your company’ 401k plan. (In the notes accompanying this article, there’s a great article from Morningstar which rates the best and worst of these state sponsored plans[5]. Also note that many states only allow you to get the state tax benefit # 2 when you invest in your states plan). To show why benefit # 1 might not be a great as you might think, you need to offset it with some math and opportunity costs B.

Overall the S&P 500 has been running at 11% yearly return[6]. Usually mutual funds for 529 contribution plans have a fee of 1%. Thus in theory, the fund must really run at an 11% yearly return. The tax savings are only on investment gains. Your investment gains, as long as long term (greater than 12 months) would be taxed at either a 15% or 20% capital gains tax as currently set up in 2018[7]. In the updated 2018 tax year, there also is a zero % capital gain bracket for individuals with taxable income of less than $38k, thus making benefit # 1 not applicable and you’ve given 1% of your investment to Fidelity.

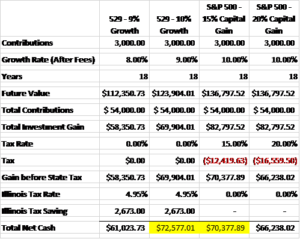

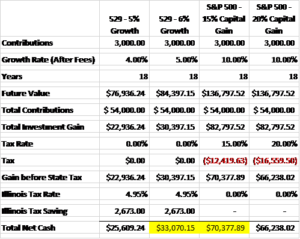

So here’s 4 quick examples to really example the math of benefit #1 to help explain if you should invest in a 529 contribution plan or not for your American Dream for your kid. For now, let’s assume your contributions are $3,000 per year and you are an Illinois resident. After 18 years, your Future Value would be based upon the growth rate of $54,000 of contribution:

- In the first example, we say the state fund is just slightly worse than the S&P 500 at 9%. Since the fees take away 1%, your actual yearly growth rate is 8%. We calculated that you have saved $2,673.00 over 18 years for state income taxes and thus your future value of net of fees plus state income tax savings is $61,023.73.

- In the second example, we say the state runs the fund at the same rate as the S&P 500, but due to the fees, your growth rate is only 9%. Thus your gain is $72,577.01 on contributions of $54,000.

- In the third example, we can look at the investment gain if we had no tax on our gains because we invested ourselves in the S&P 500 by buying through Schwab for a yearly fee of $4.95 for the yearly trade. If we make less than $77k, under new tax law, our gain would be $82,797.52 vs. $72,577.01, thus we’ve lost $10,220.51 by not investing ourselves just directly in the S&P 500, plus have huge exposure with opportunity cost A above. However if we make more than $77k, you would be subjected to the tax of 15%.

- In the fourth example, we do the same as #4, but the investor is subjected to a 20% capital gains tax and thus experiences a tax of $16,559.50 and only has a net investment gain of $82,797.52.

Again this is saying that your fund manager is allowing you to invest in funds that will give you at an investment gain of at least 1% greater than the S&P 500, which many first managers do not.

Thus here is 2 more examples showing a way lower rate of (5% & 6% growth).

Going back to my original thesis that 529 contribution plans are one of the hardest investment decisions. The reason for this is 529 contribution plans lock in your money. The ability to not have cash ability can really hurt if you have an issue that needs cash, say you need $10,000 to pay off a credit card bill. Now the rate on a credit card is 23%, thus you should take that cash out of 529 contribution plan, but now you also have that 10% penalty on those gains, plus the capital gains tax on those gains. The worst decision will be to not take that cash out and pay the credit card interest.

There also is an issue that the cash can only be used educational expenses for yourself and basically family members that can be claimed as dependents. As American’s we are a very risk adverse culture, which shocks me, that many Americans lock away their money in this risky adventures. I mention risky adventures because these funds can only be used for education. Here are some more of my reason, I believe 529 plans can be risky, as even though college for your kids is part of the America Dream, there are reason college payments might not be needed:

- What if your child decides to not go to college? What is they enter a trade school (which is currently not allowed for deduction purposes) or decide to go to the military or decides college is not for them and purposes other opportunities, like starting their own business. {Side bar – while I support college education, I don’t think parents should force their child to college, there are many people that have been very successful without a college education and by going to college your child is giving up 4 years of income and 4 years of real life job experience which might be more important in some fields than a college degree); [8]

- What if your kid gets a scholarships, while it probably not wise to bank on this, income based scholarships like Chip Evans Scholarship can help out many families in needs? Many scholarships and schools count 529 contribution plans towards a family assets and ability to pay for college and thus 529 contribution plans might hurt your chances of those scholarships. {While you don’t have to pay the 10% penalty on scholarships, you do have to pay capital gains tax on any investment gains, thus as shown above, your “state fund” would have to beat the S&P 500 by 1%};

- The educational expense can mostly be used in the US educational agencies. What if your job relocates you to Europe, Asia or Canada? What if your child wants to learn overseas?;

- By setting up a 529 contribution plan, you a saying to your kid that you will pay for their college. There probably needs to be a balance between idea and paying yourself. If you have credit card debt, you should really pay that first before a future college bill for your kid. {Catch a trend here on credit card debt}. While support is great, having a kid take on debt after college, getting loans, and working during college were all great skill sets that helped my understanding how hard work drives success & also got some real life experience in financing;

- What is the government decides one day to tax gains on 529 plan investment gains?; and

- What if the government start to fund colleges differently? What if Bernie Sanders becomes our next president and all loans are forgiven?

The 2018 tax bill did partially take out some of these concerns. Now 529 contribution plans can be used not only for qualified college educational expense, but now also $10,000 per year can be used for qualified high school educational expense, which really can make these 529 contributions plans more appealing to those who for sure will send their children to private high school.

As you can see, 529 contribution plans can lead to tax benefits, but also come with a lot of decisions and big opportunity costs and thus individual analysis that need to be thought up before just investing in them to achieve the American Dream in the most financial responsible way.

[1] https://www.businessinsider.com/no-income-tax-states-2018-2

[2] http://www.finaid.org/savings/state529deductions.phtml

[3] https://www.savingforcollege.com/529-plans/illinois/bright-start-direct-sold-college-savings-program

[4] https://www.fool.com/knowledge-center/penalty-for-early-withdrawal-from-529-plans.aspx

[5] https://www.morningstar.com/articles/867032/the-best-529-plans.html

[6] https://seekingalpha.com/instablog/605212-robert-allan-schwartz/4831186-annual-returns-s-and-p-500-1928-2015

[7] https://www.nerdwallet.com/blog/taxes/capital-gains-tax-rates/

[8] https://www.reuters.com/article/us-world-work-college/college-pay-off-seems-elusive-for-many-u-s-young-people-idUSKCN1J30ZM