FINANCIAL STATEMENTS

Overview:

Balance Sheet, Income Statement, Statement of Owners’ Equity, Statement of Cash Flows, Footnote Disclosures and the Auditor Report are all part of an audited Financial Statements. A public company needs to file an audited Financial Statement with the SEC as part of a its 10K filling. If a company takes on debt, typically the lender will require the company to send over audited Financial Statements to the lender.

Purpose:

The purpose of this article is to discuss basic Financial Statements.

Let’s define each of these statements first:

Balance Sheet – What the company owns or owes at a point of time. Common items included are Assets, Liability and Owners’ Equity (which also could be called Shareholders’ or Stockholders’ Equity).

Income Statement – The activities of the company during a point of time. Common items include Sales, Cost of Goods Sold and Net Income.

Statement of Owner’s Equity (can also be called Statement of Retained Earnings or Equity Statement)[1] – How the company ownership changed during a point in time. Common items include Owners Contributions (also called Capital Contributions), Common Stock and Dividends.

Statement of Cash Flows (or Cash Flow Statement) – How the company spent its cash during a point of time. Common items include Cash from Operations, Dividends Paid and Ending Cash Balance.

Footnote Disclosures – These are notes that go into more details about the subjects and balances included in the above 4 statements and other information that might be useful to the reader of the Financial Statements. Common items include Accounting Policies, Future Commitments and Subsequent Events.

Audit Report – This is a statement from the auditor of the Financial Statement who states if the Financial Statement are presented in accordance with the appropriate accounting policies. Typically, in The United States of America, this is U.S. General Accepted Accounting Principals (“GAAP”). Noted a financial statement does not need to include this statement and we’ll go over this more in our “What is an Audit” article.

Assumptions:

We will put together the Financial Statements of our Finance First MFC Company (“MFC” or “The Company”):

- MFC starts with an investment of $100,000 from you as the owner (Capital Contribution);

- MFC will sell pizzas at $10 per pizza and sell 20,000 pizzas during the year (Sales);

- MFC will spend $8 per pizza to make the 20,000 pizzas (Cost of Goods Sold);

- MFC will pay $1,000 per month in rent but will not make the payment for December rent (Payable at 12/31/18);

- MFC will also get paid in January 2019 for 30 pizzas which MFC sold in 2018 (Receivable at 12/31/18); and

- At the end of the year, MFC will pay the owner $20,000 cash as a reward for the successful year (Dividend).

Analysis:

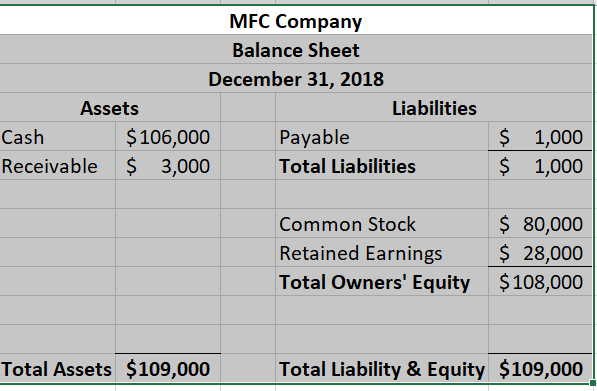

Balance Sheet

Some critical points while reviewing the Balance Sheet of MFC:

- The Balance Sheet is at a point in time, for this statement it is the Assets, Liability and Equity of MFC Company at December 31, 2018.

- Assets are items MFC owns.

- Liability are what MFC owes individuals or companies to own those assets.

- Equity is what we owe ourselves to own those assets (either through capital contributions or through operations via net income).

- From these 3 parts of the Balance Sheet we get the important accounting rule that total assets agree to the total liability and equity.

- In the above example all items are positive numbers, but in a balance sheet you can have negatives numbers. For example if the company experiences net loss or certain items that decrease in value (accumulated deprecation of fixed assets).

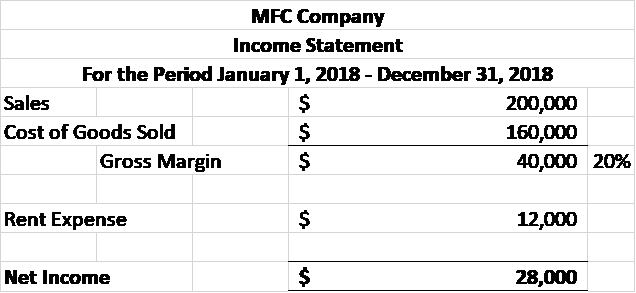

Income Statement

Some critical points while reviewing the Income Statement of MFC:

- The Income Statement is for a period of time for this statement from January 1, 2018 to December 31, 2018.

- The Income Statement is usually the easiest statement to understand in that there is only one running total vs. a Balance Sheet that has 3 running totals.

- Gross margin is a common term used in finance. This percentages tells the reader on every pizza we sell on average we make 20% of the total cash we get in the door. This is before we have to pay for any costs for Selling General and Administrative (“SG&A”), interest, depreciation, and taxes. These are costs that are not associated with the actual pizza making, think of the CEO of MFC, a marketing campaign and office supplies. Obviously, the percentage can’t be greater than 100%, but the range of what’s a good percentage depends on the industry. A car company like Ford may have gross margin percentage of 9%,[2] while Disney has a gross margin of 45%.[3]

- Net income can be positive, as in MFC’s case, or negative (and would be shown as a credit) and called net loss. Here is a link to articles on what Debit and Credits mean and Gross vs. Net.

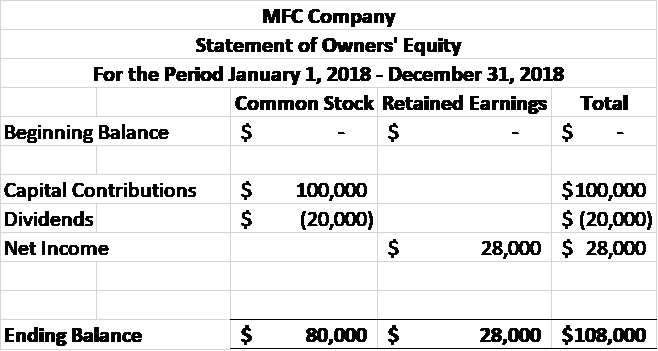

Statement of Owners Equity

Some critical points while reviewing the Statement of Owners’ Equity of MFC:

- The Statement of Owners’ Equity tells the reader how our ownership in MFC changed during the period presented for this statement from January 1, 2018 till December 31, 2018 in this example.

- The Beginning and Ending Balances will agree to the Balance Sheet, the Net Income agrees to the Income Statement and any remaining changes {for the most part} will be part of the Cash Flow statement. This is usually the smallest of all the statements and typically helps to summarize the changes in other statements.

- A capital contribution is any cash owners of MFC put into the business. Every company start with at least a beginning capital contribution and owners may decide whether to add more cash. (For Example, some companies borrow cash and thus incur debt};

- A dividend is a repayment of a surplus of profits to the owners. Normally these are not required but decided by the Board of Directors. As they are usually paid in cash, the board has to make a decision with what to do with its excess cash flow. Either pay the owners some cash or use that excess cash to grow the business by purchasing things like new fixed assets.

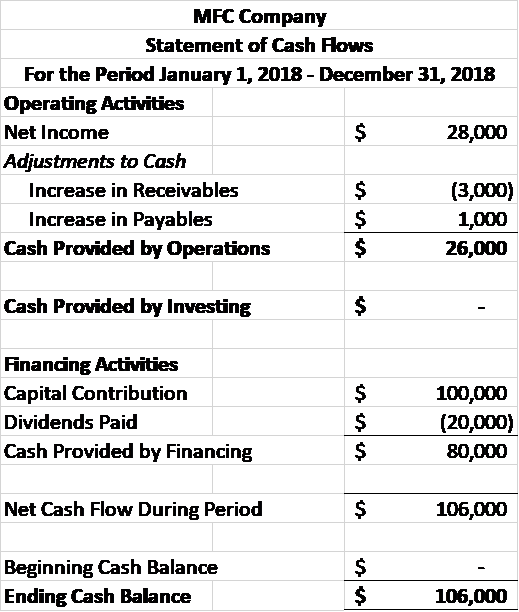

Statement of Cash Flows

Some critical points while reviewing the Statement of Cash Flows of MFC:

- The Cash Flow Statement is for a period of time for this statement from January 1, 2018 to December 31, 2018.

- A Cash Flow statement shows the reader where we spent our cash or acquired their cash and links to the Income Statement. The cash will agree to our net income with adjustments due to accrual accounting and investing & financing activities.

- A Cash Flow Statement is similar to an income statement in that it’s a running total document. There are 4 major sections, Operating Activities, Investing Activities (usually your capital expenditures), Financing Activities (debt and equity section), and the reconciliation of beginning and ending cash.

- Note that final ending cash here agrees to the ending cash on the Balance Sheet and overall MFC ended up bringing in more cash than we had in the prior year which is not always the case and can be a signal to the reader of trouble for the company.

- Here’s an article on more detailed description of each section.

After those 4 statements comes the company’s footnote disclosures. These disclosures give more details to 4 statements and sometime supplement the reader with more data. Here are 3 example of a few footnote disclosure that might be required of MFC Company.

- Summary of Significant Accounting Policies

Cash and Cash Equivalent[4]

For purposes of the consolidated statements of cash flows, the Company considers all highly liquid debt instruments purchased with an original maturity of three months or less to be cash equivalents.

- Future Commitments

Litigation

The Company currently has a lawsuit against it in the case of Walfredo Wilson vs MFC Company. The Company expects to be resolved in 2019 and the Company expects no liability to be due to any parties involved in the case and the Company has not recorded any reserves for any possible settlements.

- Subsequent Events

The Company has evaluated subsequent events through March 31, 2019, which is the date the Financial Statements were available to be issued.[5]

These footnote disclosures give extra support to each item. The accounting policies help the reader understand how the company record or treats certain items, like what they consider to be cash. The contingency in this case tells the reader that there is a lawsuit against the company, yet the Financial Statements to do no include any future payment as the company does not expect to lose. The subsequent events tells the user of anything material that might have happened since year end that’s not in the financial statements, such as a merger or acquisition.

The last part of the financial statements is actually something that for many financials statement is in the front. This is the audit report. The audit report is normally an unqualified report, noted even Enron was an unqualified report. The audit report is pretty short and standard and is here is an article for more details on an audit report. However, there may be a reason to have a qualified opinion, with this example here.

We were initially appointed auditors on February 28, 2019 which was subsequent to the end of the Company’s financial year. In consequence we were unable to carry out auditing procedures necessary to obtain adequate assurance regarding the quantities and condition of inventories and work in progress, appearing in the balance sheet at $5. There were no other satisfactory audit procedures that we could adopt to obtain sufficient evidence regarding the existence of inventories and work in progress. Accordingly, we have not been able to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion. Any adjustment to the figure may have a consequential significant effect on the profit for the year and net assets at December 31, 2018. [6]

Action Plans:

This article gives you some basic walkthrough of our company through the Financial Statements of MFC Company. It is now time for you to take your next action steps in your continued financial education:

- Google a company you’d like to understand more of and read through their financial statements contained within a 10K or 10Q filling;

- Put together your own personal financial statements. You can eliminate the disclosures portion and don’t need an audit report;

- Ask for a copy of your company’s 401(k) financial statement to understand where your retirement money sits. {Noted that some statement names are slightly different, but the same concepts mentioned above still apply}; and

- Read further articles on Finance First around Financial Statements including articles like “Understanding a 10K”, “What is an Audit”, “Accounting Basics” and “Cash vs. Accrual Accounting”.

Footnotes:

[1] http://www.quickmba.com/accounting/fin/statements/

[2] https://ycharts.com/companies/F/gross_profit_margin

[3] https://ycharts.com/companies/DIS/gross_profit_margin

[4] https://www.aicpa.org/InterestAreas/FRC/AccountingFinancialReporting/PCFR/DownloadableDocuments/FRF-SME/FRFforSMEs_Illustrative_Financial_Statements.pdf

[5] https://www.aicpa.org/InterestAreas/FRC/AccountingFinancialReporting/PCFR/DownloadableDocuments/FRF-SME/FRFforSMEs_Illustrative_Financial_Statements.pdf

[6] http://app1.hkicpa.org.hk/professionaltechnical/assurance/example_auditors/SME-FRS-Jul2009.pdf