TAX REFUND

Overview:

April 15th, Tax Day, a frightening day. However, for 70%[1] of US taxpayers this is not really a frightening day but rather tax refund day.

Purpose:

Let me know if you would agree to this:

- Loan Investor A $250 per month from January to December.

- Investor A pay you back the 12 $250 monthly payments, for a total of $3,000, on the following April 15th.

I didn’t think so. Thus, why would you do a similar thing with your paycheck and your tax dollars by getting a tax refund? {Editor note, we’ll use the term “taxes paid” throughout this topic, however most taxpayers have their taxes paid via income tax withholdings as part of their wages in their paychecks. Also note we’re using April 15th as the refund date of the following year, but in non-government shutdown years, the refunds might come in Mid-February or March dependent on when you file your return.}

When people get a tax refund, they believe they paid less tax than someone who didn’t get a tax refund. In truth whether you get a tax refund or no tax refund, your total taxes paid is the same. This is because your tax refund is your yearly income times an income tax rate (total income tax) minus the taxes you paid throughout the year.

- At the end of the year, if the amount of tax you paid during the year is greater than the total income tax, then you will get a tax refund for the difference.

- At the end of the year, if you the amount of tax you paid during the year is less than the total income tax, then you will owe for the difference.

The only difference is if you grossly underpaid you will be charged a penalty for underpayment of income taxes. Here is IRS guidance around any underpayments.

IRS Underpayment guidance:

The United States income tax system is a pay-as-you-go tax system, which means that you must pay income tax as you earn or receive your income during the year. You can do this either through withholding or by making estimated tax payments. If you didn’t pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they either owe less than $1,000 in tax after subtracting their withholding and refundable credits, or if they paid withholding and estimated tax of at least 90% of the tax for the current year or 100% of the tax shown on the return for the prior year, whichever is smaller. [2]

Assumptions:

For the rest of the article, let’s put out some basic assumptions to show how a tax refund really works:

- 2 individuals will earn a yearly income of $53,000 per year[3].

- 2 individuals will have a tax rate of 25% – this is an estimate and we’ll say that covers Federal and State taxes.

- Individual # 1 will get a tax refund of $3,000 on April 15th of the following year (as the average tax refund close to $2k to $3k[4])

- Individual # 2 will break even on his taxes (no tax refund, no overpayment).

Analysis # 1:

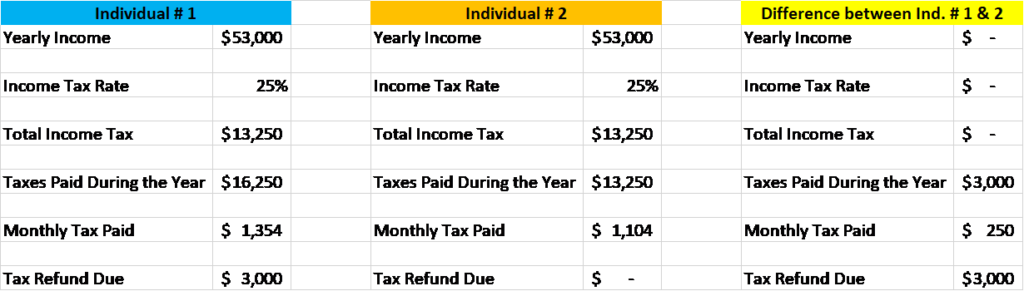

Let’s look now though how the individual income tax amounts will be calculated.

[1] https://www.cnbc.com/2018/02/20/heres-why-a-big-tax-refund-isnt-always-good-news.html

[2] https://www.irs.gov/taxtopics/tc306

[3] https://www.usatoday.com/story/money/personalfinance/2016/11/24/average-american-household-income/93002252/

[4] http://www.governing.com/gov-data/finance/average-irs-tax-refund.html

Individual # 1 & # 2 will both have total income taxes of $13,250 (25% of their $53,000 income). Individual # 2 will pay $250 less in monthly taxes during the year. Individual # 1 will get a tax refund of $3,000, but net cash paid by both individuals will be the same $13,250. The only difference is timing of when payments are paid.

Analysis # 2:

Now that we’ve shown that total taxes paid is the same whether or not you get a tax refund. Let’s show why a tax refund might not be as advantageous do to the time value of money.

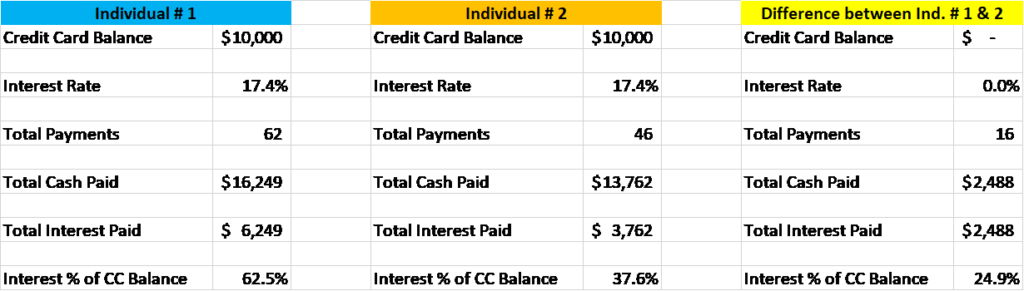

Now let’s say Individual # 1 & # 2 both have credit card debt. We’ll use $10,000 as a rough estimate of a United States individual’s credit card debt.[1] We’ll start that both have a minimum payment of $50 per month. For Individual # 1, they’ll use the April 15th tax refund to pay down debt. For Individual # 2, they’ll use the extra monthly $250 (as calculated in Analysis # 1) to pay down credit card debt above the minimum payment due each month for a total payment of $300 ($50 minimum plus the extra monthly $250 per month from Analysis # 1). For interest rate we’ll use the average rate of 17.47% ARP. [2]

At the end of the term here is what Individual # 1 & # 2 payments look like:

[1] Calculated an estimated based upon the following source: https://www.valuepenguin.com/average-credit-card-debt

[2] https://www.creditcards.com/credit-card-news/rate-report.php

The full payoff schedule of Individual # 1 & # 2 is located at the end of the article.

When we look at the payoff schedule, Individual # 2 will save interest of $2,504.42 throughout the term of the loan. Individual # 2 will also pay of the credit card balance 17 months earlier. Since Individual # 2 paid off that balance early, they’ll also have an extra $5,100 that you’ll be able to spend on whatever you’ll want.

Conclusion:

As shown in this article, a tax refund is just a cash flow deferral to yourself. Rather than waiting for any cash due to you after you file your return, you can get that cash allocated as part of your paycheck and use it to either pay down debt (and save some interest and make fewer monthly payments) or even possibly have some gains by investing that cash in stocks, bonds, etc.

Action Plans:

- Check your last 7 tax returns and see if you had a tax refund or owed money;

- If you received a tax refund, think of all the debt you could have paid down by early (and have some interest savings) having that tax refund cash earlier;

- If you received a tax refund, what did you do with that tax refund, was it a financial responsible decision;

- Check your W4 and recalculate your withholdings and try to limit your tax refund; and

- If you were to owe taxes, how would you pay for that underpayment.

Appendix:

Full payoff Schedule from Analysis # 2