Inflation on Cash Savings Account

Overview:

I use this quote on all the investment education I send my friends. From the podcast Listen Money Matters: “What would you say to a friend who has $10,000 in a cash savings account”? Andrew: “I’d throw up”. There are two reasons for joke:

1. A cash savings account is losing money to inflation.

2. By having your cash in a cash savings account in a bank, you also have an opportunity cost from other forms of investment opportunities (or paying off debt).

Purpose:

The purpose of this article is to show you a few examples of how inflation really eats away at your earnings if you have your cash in a cash savings account. We’ve defined inflation in another Finance First article, but inflation is basically the idea that a dollar today will not be worth a dollar tomorrow (in fact much less).

Assumptions:

Let’s go through a basic example of how inflation eats away at your earnings. Here are some assumptions we’ll make for an individual Joe:

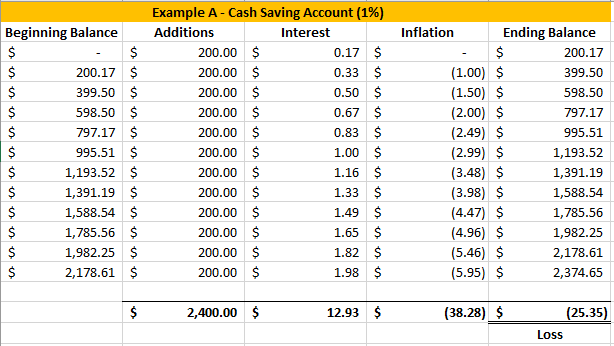

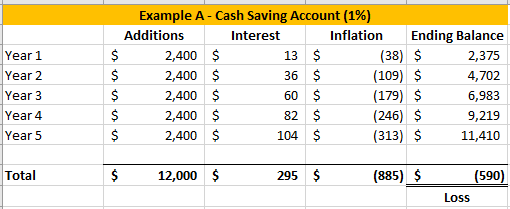

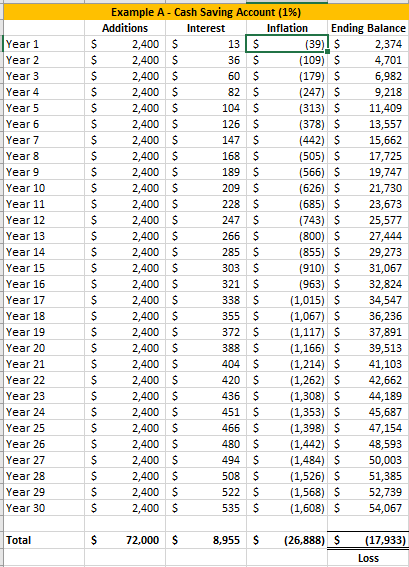

– Joe will invest $200 per month in a cash savings account, which is approximately 4% of the monthly net cash for Joe. I’ll be generous and state the bank is offering us a 1% interest rate on our deposit account. We’ll call this Example A.

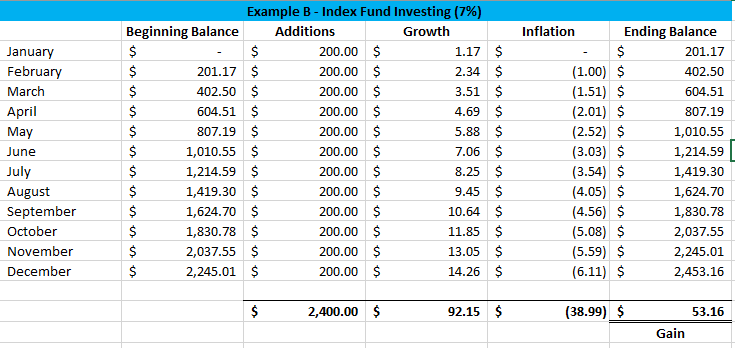

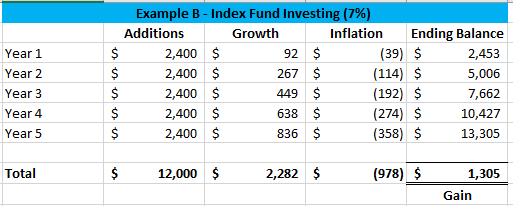

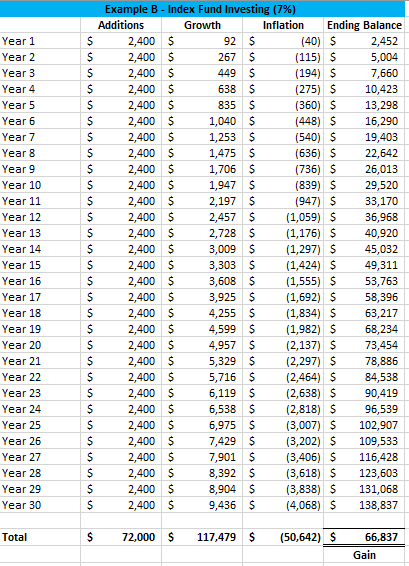

– As a comparison, Joe will invest $200 per month in an index fund matching the S&P 500 and will be getting a growth rate of 7% on the investing account. We’ll consider this growth rate reasonable rate of investment in stocks[1] based upon past returns. We’ll call this Example B. {Editor Note: We’ll call Example A: Deposit Account and Example B: Investing Account}

– We’ll estimate the yearly inflation rate of 3%. We’ll consider this a reasonable rate as it was the median of the average inflation rate from 1914 – 2018 of 3.25% & the average inflation rate from 1983 – 2018 rate of 2.70%.[2].

Analysis # 1:

First, let’s look at a 1-year time frame. By the end of year 1, in Example A, Joe would have lost $25.35 of purchasing power due to inflation. This is the net of the growth of his deposit account due to yearly interest minus the inflation cost on the deposit account.

In Example B, we’ll instead invest into an index fund and experience the market rate of growth of 7%. In Example B, we’ve actually grown our investing account by $53.16. The difference between Example A and B in Analysis 1 is $78.51 over just one year. This difference between Example A and B is the net of the opportunity cost, which I mentioned at the beginning of the article, and the inflation that we cannot escape.

Analysis # 2:

Next, let’s look at a 5-year time frame. By the end of year 5, in Example A, Joe would have lost $590 of his purchasing power due to inflation, which is 4.92% of Joe’s original contributions to the deposit account gone due to the power of inflation.

By the end of year 5, in Example B, we’ve actually grown our account by $1,305 or 10.87% more than your original contributions. The difference between Example A and Example B in Analysis 2 is $1,895 over just 5 years.

Analysis # 3:

Last, let’s look at a 30-year time frame. By the end of year 30, in Example A, Joe would have lost $17,933, or 24.91% of the original investment, of his purchasing power due to inflation.

In contrast, by the end of year 30, in Example B, we’ve actually grown our account by $66,837 or 92.83% more than your original contributions. The difference between Example A and Example B in Analysis 3 is $84,770 over 30 years.

Conclusion:

As you can see, inflation really eats away at any account balance as you got farther into the future. Thus, as you review how you handle our excess cash flow, you need to understand any possible loss of future purchasing power due to inflation. If you need that cash in the future, it might be worth your time to make sure that the money that you are lending as either a deposit in a bank account or in an index fund, that you might sure at least getting back as much return as inflation or you will lose some future purchasing power (and have a lost opportunity cost of not investing in a higher return).

Action Plans:

While inflation in the United States has recently been at a decently low level, compared to the 1980s, long term we expect inflation to continue to grow. As a substitute from a cash savings account, if you were to need some cash, below is some options one might look into that might help someone save money greater than inflation and then be able to have cash to pay on a short-term basis:

- If you own your home, open up a line of credit. Usually these have pretty cheap annual fees and the interest rates are just about the same rate as your house. It’s a way to also pull equity out of your house. See Finance First article for more on home equity lines of credit;

- Take a loan against your 401(k). Most plans allow it, interest rates are usually low, and most plans require the interest to be paid back to your specific investment account;

- Sell some investment gains. As long as you are a long-term investor, your taxable capital gains income tax rate will only be 20%. Additionally, as I’ve said before, what’s the purpose of investments if you can’t take some of money out of them; and

- Open up a new credit card to fund the downfall. This is probably the worst solution – but usually you can open up a few credit cards to get a cumulative large credit limit, plus some benefits from using the cards (like 1% rewards).

[1] Taken per total real rate of return from: http://www.simplestockinvesting.com/SP500-historical-real-total-returns.htm

[2] https://www.usinflationcalculator.com/inflation/historical-inflation-rates/