Reinvested Dividends

Overview:

Albert Einstein is said to have said “Compound interest is man’s greatest invention.”, “Compound interest is the greatest mathematical discovery of all time.”, Compound interest is the eighth wonder of the world”, Compound interest is the most powerful force in the universe”, and “Compound interest is more complicated than relativity theory.” [1] Ask Warren Buffett for the single most powerful factor behind his investing success, and he’d respond “compound interest” — without skipping a beat.[2]

Purpose:

The purpose of this article is to discuss one investing topic, dividend reinvestment. Dividend reinvestment holds to the power of compound interest.

Assumptions:

As discussed in other articles, a dividend is a repayment from a company to its shareholders. Typically, an investor could either get that dividend in cash or allow for a reinvestment of the dividend. A reinvested dividend is something that allows the owner to take that dividend and buy the number of shares equal to the current price of the stock. Reinvested dividends take form of compounding interest in that if you reinvest dividends over time, your total shares will continue to grow. To explain how this works, let’s work through a problem together with the following assumptions for you as owner of MFC Company:

- The current stock price will be $100;

- We’ll have $10,000 to invest at Day 1 of year 1 (thus we’ll be able to buy 100 shares – $10,000 divided by share price of $100); and

- Dividends will be paid out yearly at $4 per year, a dividend yield of 4% (calculated as $4 per share divided by the current price of $100 per share).

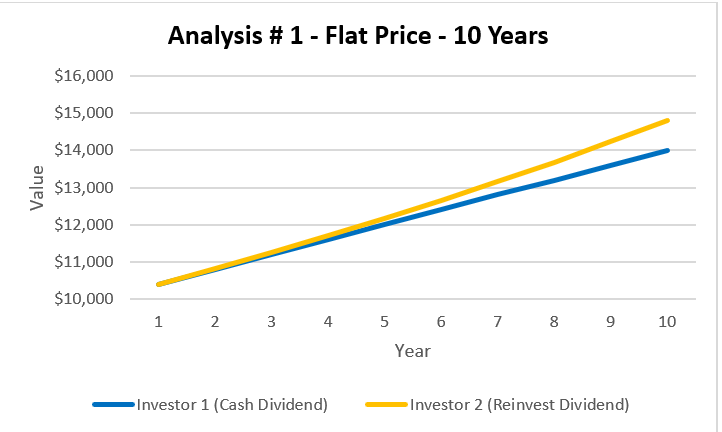

Analysis # 1 – Flat Price – 10 Years:

In this analysis, we’ll assume that the share price will not change during the 10-year period.

Investor 1

- Will take the cash and not reinvest the dividends.

- The investor will get $4,000 in cash (100 shares * $4 per year * 10 years).

Investor 2

- Will reinvest the dividends into more MFC ownership.

- By end of year 1, this investor will have 104 shares. Which is recomputed as follows:

- 100 shares * $4 per share, which means $400 in cash

- $400 divided by $100 per share means 4 extra shares to be purchased

- By end of year 2, this investor will have 108.16 shares, which is recomputed as follows:

- 104 shares * $4 per share, which means $416 in cash

- $416 divided by $100 per share means 4.16 shares to be purchased

- And so on, by the end of year 10, the investor will own 148.02 shares

Investor 1 would have a total investment worth $10,000 plus $4,000 in cash dividends for a total of $14,000.

Investor 2 would have a total investment worth $14,802.44 which is an additional $802.44 of income compared to Investor 1.

While this does not look like that much, Analysis # 1, is if there is no change in price.

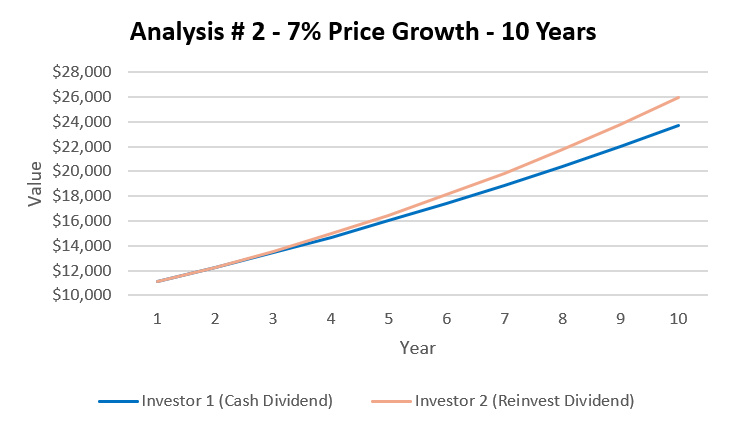

Analysis # 2 – 7% Price Growth – 10 Years:

In this analysis, we’ll assume that the share price will grow yearly at 7% per year (The yearly growth of 7% is deemed a reasonable growth rate of investment in stocks[3]).

Investor 1

- Will take the cash and not reinvest the dividends.

- The investor will get $4,000 in cash (100 shares * $4 per year * 10 years).

Investor 2

- Will reinvest the dividends.

- By end of year 1, this investor will have 103.74 shares. Which is recomputed as follows:

- 100 shares * $4 per share, which means $400 in cash

- Price in year 1 was $100 will grow by 7% to get to $107 per share

- $400 divided by $107 per share means 3.74 extra shares to be purchased

- By end of year 2, this investor will have 107.36 shares, which is recomputed as follows:

- 74 shares * $4 per share, which means $414.95 in cash

- Price in year 2 was $107 will grow by 7% to get to $114.49 per share

- $414.95 divided by $114.49 per share means 3.62 shares to be purchased

- And so on, so that by the end of year 10, the investor will own 131.91 shares

Investor 1 would have a total investment worth $19,671.51 (ending share price of $196.72 * 100 shares) plus $4,000 in cash from dividends for a total of $23,671.51, which is an annualized return of 13.67%.

Investor 2 would have a total investment worth $25,948.17. An extra $2,276.65 in 10 years compared to Investor 1, which is an annualized return of 15.95%.

Notice that the number of shares owned by investor 2 is down from analysis 2 to 1. This is due to the increase in yearly stock price is allowing the investor to buy less shares per reinvestment. However, the total investment balance has greatly increased even with less shares.

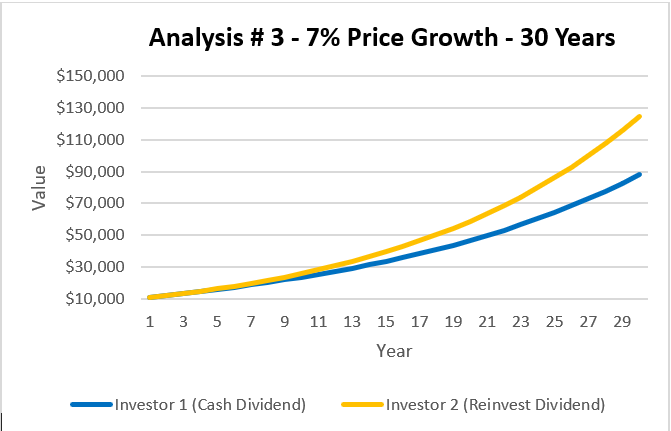

Analysis # 3 – 7% Price Growth – 30 Years:

Analysis 1 was previewing if you wanted to sell a flat stock at the end of year 10. Analysis 2 was selling during a normal market period (we have assumed annual return of 7%, while up and down markets and rates will change the analysis, the overall principals hold the same). Analysis 3 will be a long-term holder, looking at a retirement account for 30 years down the road.

Investor 1

- Will take the cash and not reinvest the dividends.

- The investor will get $12,000 in cash (100 shares * $4 per year * 30 years).

Investor 2

- Will reinvest the dividends.

- By end of year 1, this investor will have 103.74 shares. Which is recomputed as follows:

- 100 shares * $4 per share, which means $400 in cash

- Price in year 1 was $100 will grow by 7% to get to $107 per share

- $400 divided by $107 per share means 3.74 extra shares to be purchased

- By end of year 2, this investor will have 107.36 shares, which is recomputed as follows:

- 74 shares * $4 per share, which means $414.95 in cash

- Price in year 2 was $107 will grow by 7% to get to $114.49 per share

- $414.95 divided by $114.49 per share means 3.62 shares to be purchased

- And so on, by the end of year 30, the investor will own 163.40 shares.

Investor 1 would have a total investment worth $76,122.55 (ending share price of $761.23 * 100 shares) plus $12,000 in cash from dividends for a total of $88,122.55, which is an annualized return of 26.04%.

Investor 2 would have a total investment worth $124,383.93. An extra $36,261.38 in 30 years compared to Investor 1, which is an annualized return of 38.13%.

As you can see on just on an original investment of $10,000, by just reinvesting dividends, we can get an additional $36k in 30 years, perfect for our retirement.

Conclusion:

As you can see Investor 2 will end up in a better position in Analysis 1, Analysis 2 and especially in Analysis 3. [The one thing we did not factor into our analysis was what would Investor 1 do with that cash dividend. In the above we assumed the investor would just spend the cash thus gain no additional return. However, the Investor 1 could invest those cash dividends and earn something with that cash. Looking at Analysis 2 only, if Investor 1 could get more cash in another investment greater than 7%, why would the investor even be an investor in MFC Company? Why wouldn’t that investor take the original investment and put it all into the investment that is earning better than 7%? Thus, we’ve assumed Investor 1 will take the cash dividends and put it into a savings account with basically no interest income].

Action Plans:

- Review your investments and see if they are compounding interest. Do your own analysis to see if you’re better off with reinvesting your dividends or using that cash for other opportunities (i.e. opportunity cost);

- Read other Finance First Articles on compounding interest; and

- Read some articles online on compounding, here’s an example of good article

Footnotes:

[1] https://quoteinvestigator.com/2011/10/31/compound-interest/

[2] https://www.marketwatch.com/story/this-warren-buffett-rule-can-work-wonders-on-your-portfolio-2016-04-26

[3] Taken per total real rate of return from: http://www.simplestockinvesting.com/SP500-historical-real-total-returns.htm