Rule of 72

Overview:

How quickly can I double my money? What rate do I need to double my money in 5 years? What rate do I have to achieve in order to double my money in 2 years?

Purpose:

If you ask these questions, you’re in luck, as there’s actually a pretty easy math calculation to help us figure those questions out. The Rule of 72 is a principle based upon compounding (review compounding articles here) and helps us determine how to double any number over time with a consistent rate. The Rule of 72 is:

– Years to Double Your Initial Investment = 72 divided by the constant rate

o For the rest of this article, we’ll call the constant rate the growth rate. Though this calculation can be used for many different purposes besides just growth of money.

o Also we’ll use the following math symbols of “ / ” for divided by and “ * ” for multiple by.

Analysis # 1:

Let’s do a simple calculation to show how this principle works:

– Say your growth rate is 10% and you want to figure out how long it will take you to get your original investment of $1,000 to be $2,000 or double your initial investment. The Rule of 72 says Years to Double Your Initial Investment = 72 / 10% which would then equal 7.2 years.

– To prove this out let’s walk through the math. In year 1 you make an initial investment of $1,000. At the end of the 1st year you earn 10% on that investment, so your earnings in year 1 would be $100 ($1,000 * 10%).

– On year 2, you have a beginning balance of $1,100. At the end of the 2nd year you earn 10% on that investment, so your earnings in year 2 would be $110 ($1,100 * 10%). And so on.

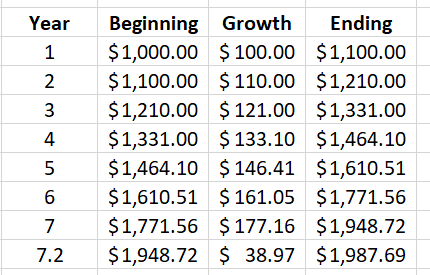

– The yearly calculation is shown below:

- As you can see the yearly growth is bigger and bigger due to compounding. Do note this is only an estimation process, thus at 7.2 years you’re just slightly short of doubling your initial investment (or $2,000). But for a simple calculation, this estimate works good enough.

Analysis # 2:

– Let’s now say you need to double your initial investment in 5 years. Again, the Rule of 72 can help us out by solving for “x” or the yearly growth rate we need to achieve in order to double our initial investment in 5 years.

– 5 (the Years to Double Your Initial Investment) = 72 / x (the growth rate).

– Remember basic algebra, in order to solve for x, the first thing we need to do is isolate x. To do this we multiple both sides of the equation by x. Thus, on the left side we would have 5 * x and on the right side we would have 72 / x * x. Simplifying the equation leaves us with 72 on the right side (see calculation below for step by step detail).

o Remember in algebra you can multiple or divide both sides of an equation by the same number and the equation will not change.

– We now have 5 * x = 72. Using the same principle above, we divided both sides by 5 and get 5 * x / 5 = 72 / 5. Solving for the left side we get x (and have succeed in isolating x by itself). On the right side we get 72 / 5 or simplified we get 14.4%. Thus, we need to have a yearly growth rate of 14.4%.

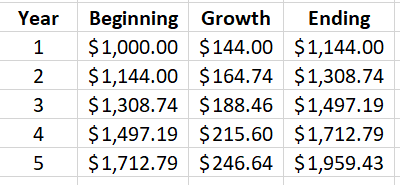

– We can prove this calculation as shown below using the same calculation we did Analysis # 1.

– Again, we are a little short of doubling our money due to the estimation of the Rule of 72, but materially this calculation work.

Analysis # 3:

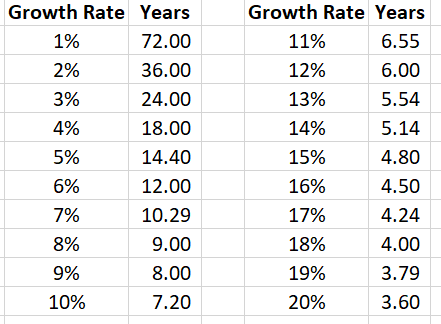

Below is a calculation of growth rates and how many years it will take you to double your initial investment using the Rule of 72.

Analysis # 4:

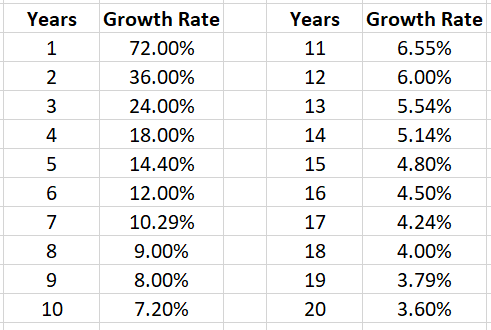

Below is a calculation of years to double your initial investment and the growth rate you’d need using the Rule of 72.

Conclusion:

As you can see there is some estimation in the calculations, but overall the Rule of 72 is a quick, dirty and easy calculation to find out when you can double an original investment. Most importantly, this Rule of 72 shows again the power of compounding and how a big change in your investments are driven by the principle of compounding.

Action Plans:

– Review articles and calculations on compounding;

– Understand your investments and debt and see how compounding and the Rule of 72 will affect you; and

– Look at your own investments and debts and calculate the Rule of 72 to get a feeling for when your initial investment might double.